Make sure you bring the right sling

By Patrick Wang, Chief Digital Economist, LQ Digital

It seems like every day you hear of a new Fintech startup entering the market with a better mousetrap. New technologies from Google and Facebook have allowed disruptors to reach customers directly, blockchain has created new ways to underwrite contracts, and emerging mobile and data techniques are changing the way companies can deliver financial services quickly and at lower cost to the consumer. Like the David, their ability to strike where it matters have allowed them to exploit chinks in the armor of large traditional financial services companies.

Despite the interest and hubris of all Fintech disruptors however, Fintech companies would be wise to respect that Finserv incumbents are still Goliath’s in the space and for good reason. Challenging them in the wrong way will lead to certain defeat as they can be crushed by their sheer mass and resources. Banks and other financial institutions have spent the better part of a century consolidating and monetizing the value of each customer they capture. They can afford to take a loss on an initial transaction so that they can ultimately cross-sell customers into other services.

Take for example: JP Morgan Chase. After 100+ years rolling up Finserv offerings – they can afford to acquire checking and savings customers at a loss – by creating an engagement vehicle to market a full line of financial services from mortgages, home equity, unsecured loans etc, and vice versa for other product lines.

In contrast, a Fintech disruptor like LendingClub started out tackling personal loans with a best of breed solution – offering quicker funding, better rates, and ease of service based on novel capital sources and new lending risk models. An attractive value proposition on its own, but is it enough to build a competitive business in a room filled with giants?

What’s the Problem?

The challenge for all Fintech disruptors trying to grow profitably is this:

They must be surgically precise about the profile of financial customers they are looking to acquire because:

- Large incumbent banks have had the luxury of being less precise with their customer acquisition strategy because they offer a full line of services (they can bring everyone in and offer something of value)

- Copying a large bank’s broad go-to-market will lead to Fintech disruptors depleting their limited growth budgets, while quickly finding out that they can’t service many of those customers profitably.

Making a hard problem harder is U.S. financial marketing compliance.

- U.S. Fair Lending regulations restrict targeting consumers by many of the dimensions that can signal customer value to a Fintech disruptor. With this constraint, many Fintech companies are quickly forced down a path where they find themselves in a crowded acquisition market with not one, but two or three large incumbents with little room to maneuver.

Fintech disruptors have much less room for error when it comes to acquiring customers.

- Large banks have large balance sheet and an already established portfolio of customers to lean on, so they are insulated from customer acquisition investments gone bad. A fintech disruptor has less margin for error as a bad bet can submarine their growth.

The margin for error continues to erode.

- Cost per clicks (CPC) continue to rise year over year as the competition for growth continues to increase with both traditional finserv and fintech companies going after the same fixed pools of interest.

Bringing a Sling to the Customer Acquisition Melee

What does success require a Fintech disruptor to stand a chance and not get crushed by exorbitant CPC’s, locked up lead marketplaces, and loss-making acquisition?

- Having a clear sense of the specific customer profile where they have an unfair advantage of converting customers.

- Knowledge of both new and old pathways to financial customers and who the customer brokers are in those spaces. Knowledge of these go-to-market channels allows Fintech companies to comply with regulation and at the same time target and segment their customer acquisition.

- A detailed and precise instrumentation of their sales cycle tied to the marketing channels that drive acquisition so that they have confidence in the acquisition investments they are making in advance of revenue.

Why Partner and Why Now?

- Diversity of Skills – Few individuals and organizations have the diversity of skills needed to be a successful all-in-one team (e.g. data science, media buying, conversion design and tech, messaging, etc.). It’s a multi-disciplined approach that requires skills from scrappy startups and knowledge of the “old world”.

- Data Capture / Benchmarking – Success requires capturing as much data as quickly as possible and then comparing those to 3rd-party benchmarks on channel performance. With access to this data, Fintech disruptors can quickly assess – is it our offering? Or is it the customer? Having a partner that’s worked with many other Finserv companies allows you a unique perspective on “what’s to be expected in the space”.

- Measuring Segment Unit Economics (performance from marketing KPIs down to LTV) – Calculating the potential likely future revenue / profit from each lead source or type is critical to helping you direct today’s media spend towards the channels and conversion strategies that will deliver the most revenue and profit, at the lowest marketing cost. Expertise in knowing how to implement accurate data tracking from marketing platforms to your CRM, and then analyzing that data, can be a difficult to find internally in fast-growing startups.

- Time to Market – Once a fintech disruptor’s offering is in market, the clock is ticking. Competitors have a chance to observe and replicate many of the valuable aspects of their offer. Having established relationships with publishers and lead brokers allow companies to accelerate their growth and not stumble over many of the common pitfalls in the industry.

Why LQ?

In short – we have all of the ingredients for Finserv acquisition success.

- For LendingClub we managed media against a cost per issued loan. (So we built data precision on how media turns into revenue, and built markers earlier/higher up in the funnel that signaled which leads were more likely to turn into revenue).

- For one of the largest multi-national financial services institutions, we helped them optimize their Direct to Consumer mortgage channel, accelerating their time-to-market by 1) short-listing the lead partners to work with, 2) rapidly stand up those relationships, and 3) optimizing each relationship against a cost per funded loan performance metric leveraging performance data captured through a lead conversion process we managed.

- For SmartBizLoans, we are able to target the specific profile of small business owners who can both credit and revenue qualify for their loans. (So we know precisely how to target serviceable customers).

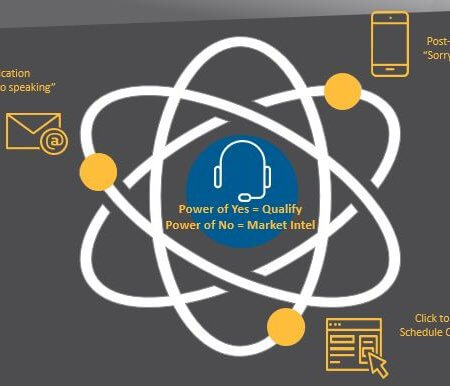

Not only has LQ worked with a large portfolio of Finserv organizations (traditional and disruptive) for media buying and customer acquisition, but we also deeply understand the sales cycle. We put our own employees on the frontline calling prospects and we learn very quickly what motivates a Finserv customer to take action, qualifying and transferring over 250,000 leads / month.

Ready to learn more? Contact us today or download this white paper to learn about what it takes to become a Digital Economist.